| Opinion |

A Long Opinion implies that there is a high probability that stock should move up over the next 60-90 days. A Neutral Opinion suggests that the supply/demand condition of the stock is in a state of flux and the likelihood is that the stock will trade sideways over the near term. A Neutral from Avoid indicates that the supply/demand condition is improving while a Neutral from Long indicates that the supply/demand condition is deteriorating. An Avoid Opinion can either denote a Short Sale candidate or a stock that has lost its positive momentum characteristics at this time should trade sideways to down over the next 30-60 days. |

||||||||||||||||||||||||||||||||||||

| Power Rating |

The Power Rating is a proprietary indicator comprised of seven uncorrelated technical indicators properly weighted so as to label stocks as being either in a strong or weak technical condition. Readings vary between -60 and +100. Plus 60 and higher is regarded as Bullish and will trigger a Long Opinion, while readings of -27 and lower will generate an Avoid Opinion. As the Power Rating crosses zero, a Neutral Opinion is generated. A Long rating is a recommendation to Buy. No action is recommended on stocks with a Neutral rating, and stocks with Avoid ratings may be considered Short Sale candidates. It is important to note whether the Power Rating is increasing or decreasing in value. A stock rated Long had a Power Rating greater than +60 at one time or the Long Opinion would never have been generated. As the Power Rating declines below +20 the technical condition of the stock is deteriorating and the odds are high that a Downgrade to Neutral will occur. Conversely, as the Power Rating of a stock rated Avoid increases to above -10 the stock is gaining strength and as the Power Rating crosses zero, it will be Upgraded to Neutral. |

||||||||||||||||||||||||||||||||||||

| C-Rate (Confidence Rating) |

The C-RATE represents the projected percentage price move left in a stock. As the stock approaches this level, the C-RATE will decrease (or increase) to 0, signalling that the stock has reached its target. C-RATES should be used in conjunction with the Opinion to determine the degree of strength associated with the Long, Neutral, or Avoid rating. C-RATES of +8 or higher, coupled with a Long Opinion denote a strong Buy. Conversely, C-RATES of -4 or lower, when coupled with an Avoid Opinion, suggest a weak condition. Research suggests that C-RATES of +20 or higher and -10 or lower should be disregarded, as some extenuating circumstance has occurred in the stock, such as a takeover or a negative earnings surprise. |

||||||||||||||||||||||||||||||||||||

| Stops |

Stops for stocks rated Long (Buy) are calculated by averaging the stock's most recent significant lows. This calculation generates a SELL stop. Conversely, BUY stopS are generated by averaging recent significant highs for stocks rated Avoid. The logic behind this method of determining Stops is that previous highs and lows represent short term resistance and support areas. The Stops are formulated in such a way that they follow the stock if it is moving in a profitable direction so as not to allow the position to give back its gains. If, however, the price moves against the position, the Stop remains the same until the position is stopped out. Users should consider penetration of the Stop to be an early warning of a change developing in the price trend of the stock. |

||||||||||||||||||||||||||||||||||||

| Oscillators (STO Fast %K and Slow %K) |

Oscillators are technical indicators designed to identify either Overbought or Oversold conditions. A stochastic is one type of an oscillator indicator. "Second Opinion" calculates both the Fast and Slow %K Stochastic. Fast %K reflects the position of the price of the stock is in its trading range over the last five days. Slow %K smoothes Fast %K to make it less erratic. The Stochastic Oscillator ranges between 0 and 100. Values under 20 identify stocks that are regarded as Oversold (Buy) while values over 80 signal Overbought (Sell) conditions. When looking to initiate a Long (Buy) position, wait for low (oversold) STO (Slow %K) readings. Conversely, when looking to exit a Long position, wait for high (overbought) STO (Slow %K) readings. |

||||||||||||||||||||||||||||||||||||

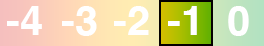

| Opinion Score |

|

| Opinion | Score | Interpretation / Market Risk |

|---|---|---|

| Long |

|

Stock is a buy. Market risk is low. |

| Long |

|

Stock is a buy with minor deterioration. Market risk is low. |

| Long |

|

Stock now experiencing technical deterioration. Market risk is moderate but increasing. |

| Long/Neutral |

|

Warning sign if you own the stock. Significant technical deterioration. A good point to begin evaluating your individual Buy-Hold-Sell strategies. Market risk is significantly increasing. |

| Long/Neutral |

|

Warning sign if you own the stock. Extreme technical deterioration. Market risk is high. |

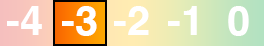

| Opinion | Score | Interpretation / Market Risk |

|---|---|---|

| Avoid |

|

Stock is an Avoid. Market risk is high for buyers. |

| Avoid |

|

Stock is an Avoid with minor improvement. Market risk is high for buyers. |

| Avoid |

|

Stock now experiencing technical improvement. Market risk is moderate but decreasing for buyers. |

| Avoid/Neutral |

|

Warning sign if you are short the stock. Significant technical improvement. A good point to begin evaluating your individual Buy-Hold-Sell strategies. Market risk is significantly decreasing for buyers. |

| Avoid/Neutral |

|

Warning sign if you are short the stock. Extreme technical improvement. Market risk is low for buyers, but not as low as a Long with a score of 0. |

| Close (Daily Close) |

Previous day's Closing Price. |

| Open (Daily Open) |

Previous day's Open Price. |

| High (Daily High) |

Previous day's High. |

| Low (Daily Low) |

Previous day's Low. |

| Change (Daily Change) |

Previous day's change in price. |

| YrHigh-YrLow (Year High-Low) |

The inter-day High and Low for the trailing twelve month period, adjusted for any stock splits. |

| Mo Chg % (Monthly % Change In Price) |

The percentage change in price during the previous twenty trading days. |

| Support/Resistance Ranges |

Support/Resistance ranges are areas of price congestion where the stock found support or ran into resistance, respectively. They are different from the Support/Reistance Trend Line, which are calculated by connecting a series of recent lows (support) or recent highs (resistance) with a straight line. The Support/Resistance Ranges are much shorter-term values than the trend line values. |

| Support/Resistance Trend Line Values |

Support/Resistance trend lines are constructed by connecting either the most recent, significant lows (Support) or high points (Resistance) on the stock's chart. To have a valid Support Trend Line, the slope of the line should be pointed UP. Conversely, a valid Resistance Trend Line should be pointed DOWN. In situations that the trend lines are not pointed in the proper direction, a NA will appear instead of a value. "Second Opinion" constructs three Support and Resistance trend lines for each stock in the database. The reported values represent the trend line's value that is farthest away from the closing price of the stock provided that this number is less than a 20% differential. If the stock is more than 20% away from either the Support or Resistance trend line, the program will report the value of the next closest trend line and so on. |

| Buy/Sell Stop |

Depending on the status of the computer's technical Opinion for a particular stock, either a Buy Stop or Sell Stop is calculated for the stock. These stops are generated by locating the most recent cyclical Low or High at the time that the Opinion was originated. Stocks that have a Long Opinion would have a SELL stop based on the previous cyclical Low. Stocks with an Avoid Opinion would have a BUY stop based on the stock's previous cyclical High.

The stop remains unchanged under the following circumstances: The price of the stock moves adversely from its opening price.

The Opinion changes from Long or Avoid to Neutral.

The stop will change under the following circumstances: The price of the stock moves favorably in which case the stop will move with the stock.

The Opinion changes from Neutral to either Avoid or Long.

|

| Volatility |

A measurement of a stock's volatility during the preceding twenty days of activity. The reading reflects the average trading range of the stock as compared to the average closing price and is presented as a percentage. |

| Position |

A measurement of the stock's closing price within the price range during the previous twenty trading days. Values range between 0 and 100. A reading of 100 means that the stock's closing price is at its high for the period, while a 0 reading would mean that the stock closed at its low. A reading of 50 denotes that the stock closed in the middle of the twenty day trading range. |

| ADXR |

J. Wells Wilder's Average Directional Movement Rating. This indicator was designed to measure the intensity of a stock's trend. Readings over 20 suggest that a stock is experiencing a trending movement while readings under 20 suggest that the stock is in a trading range. The higher the ADXR reading, the stronger the magnitude of the trend. ADXR does not indicate the direction of the trend, only its intensity. |

| Moving Averages |

"Second Opinion" performs Moving Average analysis by calculating the percentage that the stock's price is either over or under the specified Simple Moving Average (MA). This calculation is computed for the 10-Day, 21-Day, 50-Day and 200-Day Simple Moving Average. A number less than 100, ie. 92, would denote that a stock closed at a value which is 8% less than the closing value of the moving average. Conversely, a value of 120 would indicate that the closing value of the stock is 20% over the value of the moving average. In addition, the direction that the moving average is pointed is displayed next to this value (Up=Bullish, Down=Bearish). |

| Volume (Previous Day's Volume) |

The number of shares that the stock traded the previous day. |

| Avg Vol (Average Volume) |

The average daily volume that the stock has traded during the previous twenty days. |

| Mo Chg % (% Monthly Volume Change) |

The percentage difference between the previous twenty days average volume and the preceding twenty days average volume. |

| U/D Ratio (Up/Down Volume Ratio) |

A 50-Day ratio of a stock's daily Up-Volume to daily Down-Volume. This ratio is calculated by dividing the total volume on days when a stock closed Up by the total volume on days it closes Down. Readings of 1.0 and greater denote Accumulation (Bullish), while readings under 1.0 signal Distribution (Bearish). |

| U/D Slope (Up/Down Volume Ratio Slope) |

The Up/Down Volume Ratio Slope identifies the direction in which the Up/Down Volume Ratio is pointed. Although the raw U/D Volume Ratio is a valuable indicator, it is the direction or Slope of this indicator that forewarns of a change of trend in a stock's price. |

| OBV (On-Balance-Volume) |

The original theory of On-Balance-Volume (OBV) was developed by Joseph Granville. The basic assumption underlying the method is that the marketplace is divided between "Smart Money" and the "General Public." Smart money accumulates stocks at low prices and distributes it to the general public at higher prices. The OBV technique is an attempt to uncover smart money's hidden accumulation and distribution patterns before significant price movement occurs. OBV is computed in the following manner. If a stock closes up for the day, the total volume for that day is considered to have been Buy Induced and therefore the stock is under accumulation. Conversely, a stock that closes down for the day is regarded as having been under Sell Induced pressure and the trading activity is considered to have been distribution. The volume on Up days is totaled against the volume traded on Down days. The net is a running total of OBV, and is either a positive which is bullish (BL) or negative, a bearish (BR) condition. "Second Opinion" calculates net OBV totals based on trading activity during the preceding 50 days. |

| Pos OBV (Positive Volume Index) |

The Positive Volume Index relates an increase in volume to the change of a stock's price. When volume increases from the previous day, the PVI is adjusted by the percentage change in the stock's price. The PVI only changes on days when volume increases from the previous day and is displayed as either Bullish (BL) or Bearish (BR), depending whether it is above or below its 24 day moving average. |

| Neg OBV (Negative Volume Index) |

Negative Volume Index relates a decrease in volume to the change in the stock's price. When volume decreases from the previous day, the NVI is adjusted by the percentage of change in the stock's price. The NVI only changes on days when volume decreases and is displayed as either Bullish (BL) or Bearish (BR), depending whether it is over or under its 24 day moving average. |

| MFI (Money Flow Index) |

The Money Flow Index tracks the flow of money into or out of a stock. Readings below 20 indicate that a stock is Oversold, a short term bullish condition while levels above 80 suggest an Overbought bearish condition. The Money Flow Index is calculated over a 14 day period. |

| MF Slope (Money Flow Index Slope) |

The Money Flow Index Slope identifies the direction in which the MFI is pointed. Although the raw MFI value is a valuable Overbought/Oversold indicator, it is the direction or Slope of the indicator that forewarns of a change of trend in a stock's price. |

| Beta |

Beta is a measurement of a stock's volatility as compared to that of the S&P 500. Readings greater than 1.00 denote stocks that have demonstrated a greater degree of volatility than the S&P 500 during the previous year. Stocks with a Beta of .99 or less have demonstrated less volatility than the S&P during the same period. Traders who desire above average volatility should choose stocks with a Beta of 1.2 or higher. Conversely, conservative traders should only select stocks with a Beta less than 1.00. |

| MACD ST & LT (Moving Average Convergence Divergence) |

Moving Average Convergence Divergence (MACD) is a sophisticated, technical trading approach developed by Gerald Appel. MACD incorporates three exponential moving averages of price into a signal indicator that gives Buy and Sell signals based on crossovers of the various averages. MACD Breakouts occur when the MACD Directional Line crosses over the Signal Line from below and is denoted by a BL (Bullish) reading. Sell signals are generated when the reverse occurs and are denoted by a BR (Bearish) reading. "Second Opinion" calculates both the MACD-ST (Short-Term) and MACD-LT (Long-Term) indicators. MACD-ST is calculated by combining the 12, 26 and 9 day exponential moving averages. MACD-LT is calculated by combining longer term exponential moving averages. |

| 50-Day R.S (50-Day Relative Strength) |

"Second Opinion" calculates the 50-day Relative Strength (R- S) for each of the stocks in the database. Relative Strength ratings of 1.01 or higher are assigned to stocks that have out performed the S&P 500 during the last 50 days. Readings of .99 or less identify those stocks that have under performed the S&P 500. Stocks being considered for Long Positions should possess strong Relative Strength ratings of 1.05 and over, while Short Sale candidates should have ratings of .95 or less. |

| STO Slow %K & Fast %K (Stochastics) |

Developed by Dr. George Lane, Stochastic indicators are designed to identify Overbought and Oversold conditions. The Stochastic Oscillator compares where a security's price closed relative to its trading range over x-time periods. "Second Opinion" computes both the Slow %K Stochastic Oscillator and Fast %K. Values range from 0 to 100. Readings over 80 signal Overbought conditions(short term negative) while readings below 20 are regarded as an Oversold situation (short term positive). Stochastics are best used to time entry and exit points |

| Wilder's RSI (Wilder's 9 Day RSI Value) |

RSI was developed by J. Welles Wilder to detect Overbought and Oversold conditions. The Index is comprised of three variables: 1) the average of all UP closes during a given period; 2) the average of all Down closes during the same period; and 3) the length of the period in days over which these averages are taken. RSI measures the degree of strength left in a price trend. If Price has been declining and RSI drops to 30 or lower, traders should be alerted to a probable reversal of the downtrend, since momentum would appear to be losing its strength. If RSI moves above 70 as Price rises, an intermediate top is usually imminent. "Second Opinion" uses a nine day period when computing RSI. |

| Over Bought/Sold--OBOS |

The problem with Overbought-Oversold indicators is that stocks can remain in either an Overbought or Oversold area for a period of time without any significant change in price. The ideal time to act is when a stock is in a OBOS status and Price appears to be moving away from the condition. To address this problem, a proprietary Overbought-Oversold indicator (OBOS) has been developed that consists of Stochastic (Fast %K) and a Price Reversal indicator. Both indicators are assigned a numerical value, ranging from +3 to -3, and based on the length of time that the component has remained in either an Overbought or Oversold condition. The idea is to identify stocks that are in either an Overbought (OB) or Oversold (OS) area, have been in this condition for several days, and are now beginning to move away from the condition. The OBOS indicator accomplishes this goal. The OBOS indicator can have maximum values ranging from -6 to +6. Testing has shown that action is merited whenever the OBOS reaches +3 or higher on the BUY side or -3 or lower on the SELL side. |

| Bollinger Bands |

Developed by John Bollinger, these trading bands are plotted at standard deviation levels above and below a moving average of a stock's price. "Second Opinion" uses a 20 day simple moving average and 2 standard deviations when computing Bollinger Bands. The spacing between Bollinger Bands is reflected as a number that varies between 0 and 100 and depicts the volatility of the stock during the previous twenty days. Whenever these bands tighten (a value below 20), volatility has contracted, a condition that typically precedes a sharp price movement. The direction, however, of the anticipated move is not indicated by contraction of these bands. |

| RSV (Relative Strength Value) |

Relative Strength Value differs from 50-Day Relative Strength (R-S) in that it is not a measurement of a stock's performance as compared to a market index. Relative Strength Value is the percentage price change of a stock during the preceding twelve months or 250 trading days. The calculation is weighted, with the most recent three months assigned a 40% weight, while the previous nine months receive a 60% weight. All of the stocks in the database are then arranged in order of price change and ranked with a value of 99 to 1. A Relative strength rating of 92 would mean that the stock has outperformed 92% of all other stocks in the database. |